Fuel Taxes File Department of Revenue Taxation

Special fuel can be sold without excise tax to government entities, and the same guidelines as gasoline apply. All other sales of clear diesel fuel must include the excise tax. If purchasers feel they have an exempt use of the fuel, they can apply to the Department of Revenue for a refund.

Bringing Clarity to Fuel Excise Taxes and Credits

A taxpayer reports its fuel excise tax obligation on Form 720, Quarterly Federal Excise Tax Return. Once a taxpayer submits Form 720 and remits the excise taxes due, it is possible that 100% or more of the excise taxes paid can be refunded to the taxpayer if the fuel is being used for an exempt purpose or qualifies for any of several available fuel tax credits, refunds, or payments.

84131191 Other: Pumps for dispensing fuel India Import

84131191 Other: Pumps for dispensing fuel Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View.

Alternative Fuels Data Center: Propane Laws and Incentives

Alternative Fuel Excise Tax Propane and compressed natural gas (CNG) are subject to a federal excise tax of $ per gasoline gallon equivalent (GGE). The liquefied natural gas (LNG) tax rate is $ per diesel gallon equivalent (DGE).

Fuel excise Australian Taxation Office

Excise guidelines for the fuel industry. Excise duty is a tax on fuel and petroleum products (excisable goods) produced or manufactured in Australia. If you manufacture or store excisable goods you must hold an appropriate excise licence, and report to us and pay duty on goods delivered into the Australian domestic market.

Indiana Gasoline and Fuel Taxes for 2019 SalesTaxHandbook

Payment of Indiana Fuel Excise Taxes . Payments of fuel excise taxes are made by fuel vendors, not by end consumers, though the taxes will be passed on in the fuel's retail price. Fuel tax is due on the 20th of each month for the previous month or the last day of the month every three months for motor carriers road tax. Indiana Fuel Tax Reports

Publication 510 Excise Taxes Fuel Taxes IRS Tax Map

Fuel Taxes Fuel Tax Credits This means any taxable fuel produced outside the bulk transfer/terminal system by mixing taxable fuel on which excise tax has been imposed and any other liquid on which excise tax hasn’t been imposed. The emulsion additive used to produce the fuel must be registered by a United States manufacturer with the

United States biofuel policies Wikipedia

Renewable Fuel InfrastructureTax Credit, Renewable Fuel Producer Excise Tax and Inspection Exemption, Alternative Fuel Tax Exemption, Biodiesel Fuel Use Incentive Grants [ edit ] Many states have money set aside to specifically encourage the research of biofuels with the goals of increasing fuel efficiency and cost effectiveness.

Excise 11 Environmental Response Surcharge and the

Licensed fuel distributors are also required to remit any payment due by Electronic Funds Transfer (EFT). To register for EFT complete the Authorization for Electronic

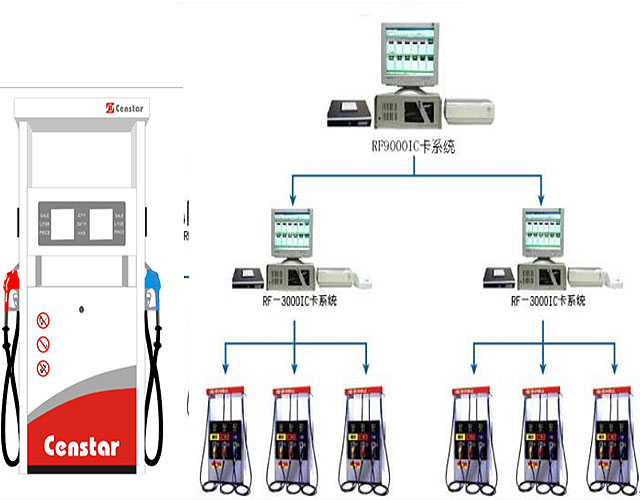

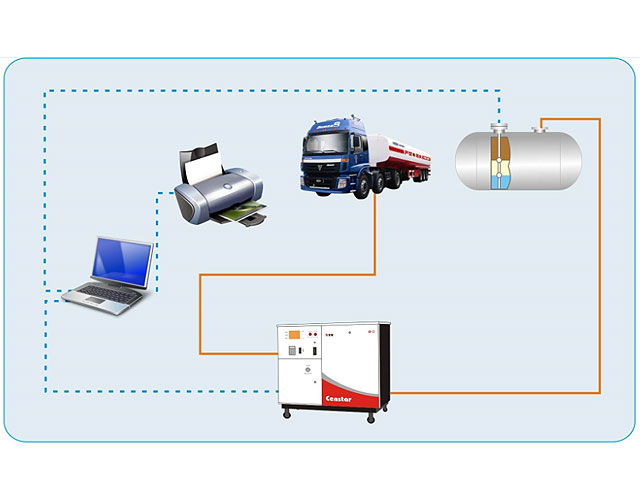

fuel dispenser & fuel dispenser spare parts manufacturer

Relied on the high qualified engineers, afuel dispenser kk fuel dispenser gastion and separation (they will all be Fuel Dispenser Supplier Aviation Fuel Dispenser D 4488 2 Fuel dispenser found to be forms of pushing apart or of pushing together), except such as are involved in the processes of begasing and perishing. (At in the former it pulls

Petroleum Products Program California Department of

What methods does the Petroleum Products Program use to determine if the gasoline and diesel fuel dispensers are delivering the correct quantity? sales tax is added on top of the 18.4 cents per gallon Federal excise tax and the 18.0 cents per gallon State excise tax.

Reference Section

PMAA Regulatory Report 2011 Federal Motor Fuel Excise Tax Rates . PMAA Regulatory Report Biodiesel Blenders Credit. New Dispenser Label and PTD Requirements for MVNRLM, Kerosene, Heating Oil PMAA. Final Dyed Diesel Tax Bulletin Aug . July 2010 Draft Dyed Diesel Fuels Tax

ARTICLE 64:07

Contractors must pay the contractors' excise tax on receipts from work done for the state and other governmental entities. The tax is to be computed on the total receipts received regardless of whether the receipt is characterized as material, labor, overhead, profit or excise tax. Piping which connects the fuel dispensers to the fuel

TAX EXEMPTION GUIDELINES FOR STATE AGENCIES

Aviation Fuel (also referred to as jet fuel) is any fuel oil that is used for fuel in an aircraft (e.g., kerosene based fuel is a common aircraft fuel). A federal excise tax of $.219 per gallon is imposed on noncommercial aviation fuel (commercial aviation fuel is generally subject to a 4.4 cents per gallon excise tax); however, State agencies are exempt.

Frequently Asked Questions About Motor Fuel

If the motor fuel excise tax is applicable, no sales tax is required. Fuel that is not subject to motor fuel excise tax becomes subject to sales tax. However, the fuel purchase may qualify for a sales tax exemption; refer to sales tax laws and regulations regarding exemptions.

Fuel Excise Tax Exemption for Trucking Companies

Fuel excise tax exemption can mean a tax refund. To operate power take off units, auxiliary engines, and refrigeration units, if they are part of a licensed motor vehicle To power an unlicensed motor vehicle used to move semitrailers within a cargo yard, warehouse facility, or intermodal facility In the past,

Items Taxed to Support Wildlife and Sport Fish Restoration

Manufacturers, producers and importers pay an excise tax on shooting, archery, and angling equipment. Recreational boaters also contribute with fuel and electric motor taxes. The U.S. Fish and Wildlife Service administers the Wildlife and Sport Fish Restoration Programs and distributes funds to State fish and wildlife resource agencies.

Excise Taxes imposed on Sale of Fuels that is reported on

Fuel Tax The federal government levies an excise tax on various motor fuels. Under current law, the excise tax rate is 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel.

Motor Fuel State Excise Tax Bulletins Department of Revenue

File & Pay; Tax Rates; Out of State Sellers; Nontaxable Sales; Tax Exempt Nonprofit Organizations; Helpful Links; What's New? Motor Fuel / IFTA. General Motor Fuel/IFTA Information; Calculating Tax on Motor Fuel; Motor Fuel Rules for Interstate Motor Carriers; Motor Fuel Tax Refund Information; Partnerships; Alcohol and Tobacco Taxes; Tax

A Guide to Fuel Dispenser Labeling in Arizona

USE FUEL TAX All diesel fuel dispensers are required to display labels notifying customers of the tax rate that is collected per gallon at that specific dispenser. Light Class diesel fuel dispensers have a $ tax per gallon. Use Class diesel fuel dispensers have a $ tax per gallon

Message

Message tel

tel Inquiry

Inquiry